estate tax law proposals 2021

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. For example in the United States only families making less than 400000 per year may claim the full CTCSimilarly in the United Kingdom the tax.

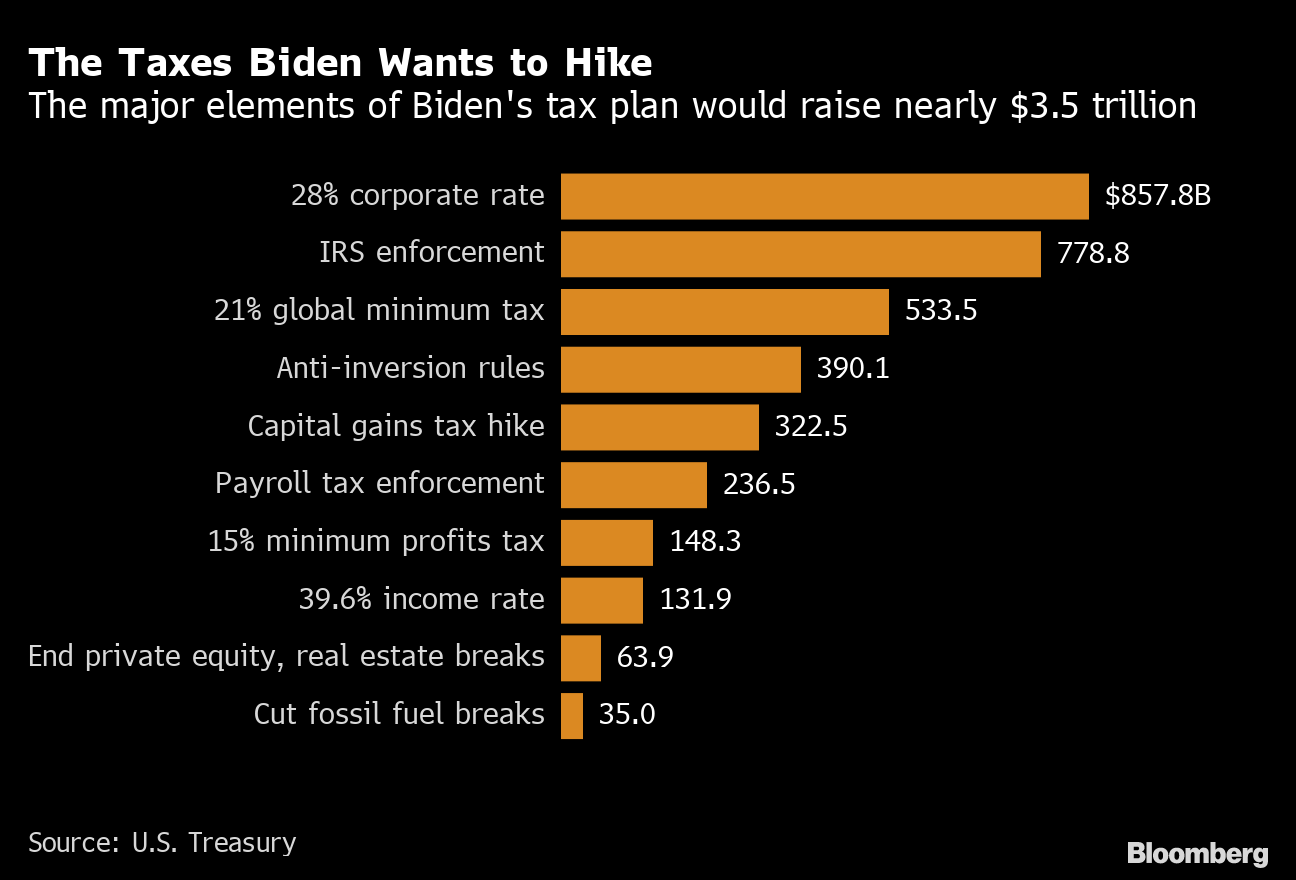

Summary Of Fy 2022 Tax Proposals By The Biden Administration

This comment explores the various proposals Congress has considered with a special emphasis on the interaction of estate tax on state revenue and.

. 15 Are any minimum employment terms and conditions set down by law that employers have to observe. For information on all estate tax closing letter. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City.

Access to People You Want to Know. The Organization for Young CRE Professionals. Based on the Tax Foundation General Equilibrium Model we estimate that on a conventional basis Bidens plan would increase federal tax revenue by 333 trillion between 2021 and 2030 relative to current law.

40 2022 1206 million. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Once again tax legislation is front and center in Washington.

Depending on how your 12 interest is held and treated under state law and how it was. Individual Top Marginal Income Tax Rate Increase. 509300 452700 and 481000 respectively.

Form 706 Estate Tax Return Packages Returned If your Form 706 package was returned to you you must. In August Congress passed and the President signed into law the Inflation Reduction Act which contained a number of important and complex tax changes affecting corporations and individuals including a new 15 minimum tax on book income a particularly important development given its similarity in name but not. The Advocate for CRE.

11580000 in 2020 11700000 in 2021 and 12060000. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. This change would accelerate the return to a top income tax bracket of 396 rather than waiting until tax years following 2025.

There are quite a few laws setting out minimum terms and conditions of employment such as the Minimum Wage Act 982 gross per hour since 1 January 2022 to be increased to 1045 effective 1 July 2022 and the Federal Vacation Act 20. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706PDF. ETCL became effective October 28 2021 User Fee for Estate Tax Closing Letter TD 9957 PDF.

Uhuru Kenyatta signed into law the Employment Amendment Act 2021 the Act. If you have received arrears of salarypension in the Financial year 2021-22 related to the previous years then your tax liability will be on the higher side due to arrears but do you know that you can bifurcate your income from arrears in respective years on notional basis and can avail relief us 891 of Income-tax Act1961. How Are Restricted Stock Units RSUs Taxed.

Among the many proposals nixed from the current legislative package is a plan to restore the top income tax rate of 396 percent brought down to 37 percent by the Trump administrations Tax. There are seven federal income tax rates in 2022. This is notwithstanding the fact that.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. EPA notes that Congress has repeatedly declined to enact proposals to amend the Clean Air Act to authorize a cap-and-trade scheme or to enact a carbon tax. Increasing the corporate tax rate to 28 percent would account for the largest revenue gain about 1 trillion over 10 years in the plan.

Citizens and residents at 5 million. Section 301 of the 2010 Act reinstated the federal estate tax. Get information on how the estate tax may apply to your taxable estate at your death.

The Estate Tax is a tax on your right to transfer property at your death. Here is an article on employee stock options. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayers income level.

Inspiring Transforming NJ. A child tax credit CTC is a tax credit for parents with dependent children given by various countries. A proposed increase in the top ordinary income tax rate from 37 to 396 would be effective starting with the 2022 tax year.

Main features of the new extraordinary prepayment on account of Income Tax General Resolution 524822 the Resolution issued by the Argentine Tax Agency AFIP and gazetted on August 16 2022 set forth an extraordinary one-time prepayment on account of Income Tax payable by corporate taxpayers contemplated in article 73 of the Income Tax law. Heres how the Biden administrations recently enacted tax law changesand new corporate and individual tax proposalsdo or could affect taxpayers. The Act was one of 3 Employment Amendment Bills introduced in 2019 1 and it is the only one that has currently been passed into lawThe Act came into force on 15 April 2021 following its gazettement through Kenya Gazette.

2022 Federal Income Tax Brackets and Rates. The new law set the exemption for US. On 30 March 2021 the President HE.

Senate passed Inflation Reduction Act of 2022 IRA with many climate energy tax credit proposals for production investment carbon oxide sequestration zero-emission nuclear power alternative. RSUs can also be subject to capital.

Property Taxes Property Tax Analysis Tax Foundation

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Secured Property Taxes Treasurer Tax Collector

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

Internet Sales Taxes Tax Foundation

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Biden S Budget Proposes Tax Hike On Married Filers Over 450 000

How The Tcja Tax Law Affects Your Personal Finances

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Fbr Called For Income Tax Proposals For 2021 2022 Budget Budgeting Income Tax Income

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Corporate Partnership Estate And Gift Taxation 2021 1st Edition Pratt Solutions Manual Pratt Corporate Solutions

The Corporate Minimum Tax Could Hit These Ultra Profitable Companies The Washington Post